The axiom “It’s not about how much you earn; it’s about what you do with what you earn” encapsulates a fundamental truth of personal finance. This article is a guide to harnessing your income effectively, allowing you to fulfill both current needs and future aspirations while expanding your means of living.

**1. **Comprehensive Financial Planning:**

Begin with a detailed evaluation of your income, expenses, and financial goals. Create a comprehensive plan that balances short-term necessities and long-term ambitions. Allocate specific amounts to various categories, including essentials, savings, investments, and expansion initiatives.

**2. Building a Solid Foundation:**

Before expanding your means, ensure a solid financial foundation. Establish an emergency fund to cover 3-6 months’ worth of expenses. This safety net protects your goals from unexpected financial shocks.

**3. Prioritize High-Interest Debt Elimination:**

Allocate a portion of your income to eliminate high-interest debts. As debt decreases, more funds become available for investments and expansion endeavors.

**4. Blend Savings with Investment:**

While meeting immediate needs is vital, consider investing in assets that appreciate over time. Diversify your investments, including stocks, bonds, mutual funds, and real estate. Over the long term, these assets can significantly contribute to your financial growth.

**5. Establish Specific Goals:**

Set clear and measurable short-term, mid-term, and long-term goals. Whether it’s buying a house, funding education, or starting a business, having defined objectives will guide your income allocation strategies.

**6. Embrace Strategic Expansions:**

Expanding your means doesn’t necessarily mean sacrificing your financial stability. Research and identify potential opportunities for supplemental income that align with your skills and passions. This could involve starting a side business, freelancing, or investing in income-generating ventures.

**7. Continuous Skill Development:**

Invest in enhancing your skills and knowledge. Continuous learning not only positions you for higher-paying roles but can also open doors to new income streams and opportunities.

**8. Networking and Collaboration:**

Connect with individuals in your industry or field of interest. Collaborations and partnerships can lead to innovative projects, joint ventures, and new avenues for income generation.

**9. Invest in Personal Branding:**

In today’s digital age, your personal brand matters. Cultivate a strong online presence through social media, blogging, or creating content. A well-established personal brand can attract opportunities and clients, boosting your earning potential.

**10. Leverage Technology and Innovation:**

Stay updated with technological trends and innovations. Embrace digital tools and platforms that can streamline processes, enhance productivity, and create new income streams.

**11. Track Progress and Adapt:**

Regularly review your financial plan and track your progress. If certain strategies aren’t yielding the desired outcomes, be open to making adjustments. Flexibility is key to optimizing your income utilization.

Conclusion:

Maximizing income utilization is an art that requires a delicate balance between immediate needs, long-term goals, and expansion efforts. By constructing a comprehensive financial plan, strategically investing, setting specific goals, and embracing innovative opportunities, you can transform your income into a powerful instrument of prosperity. Remember, it’s not just about the money you earn; it’s about the strategic decisions you make with that money that can reshape your financial destiny.

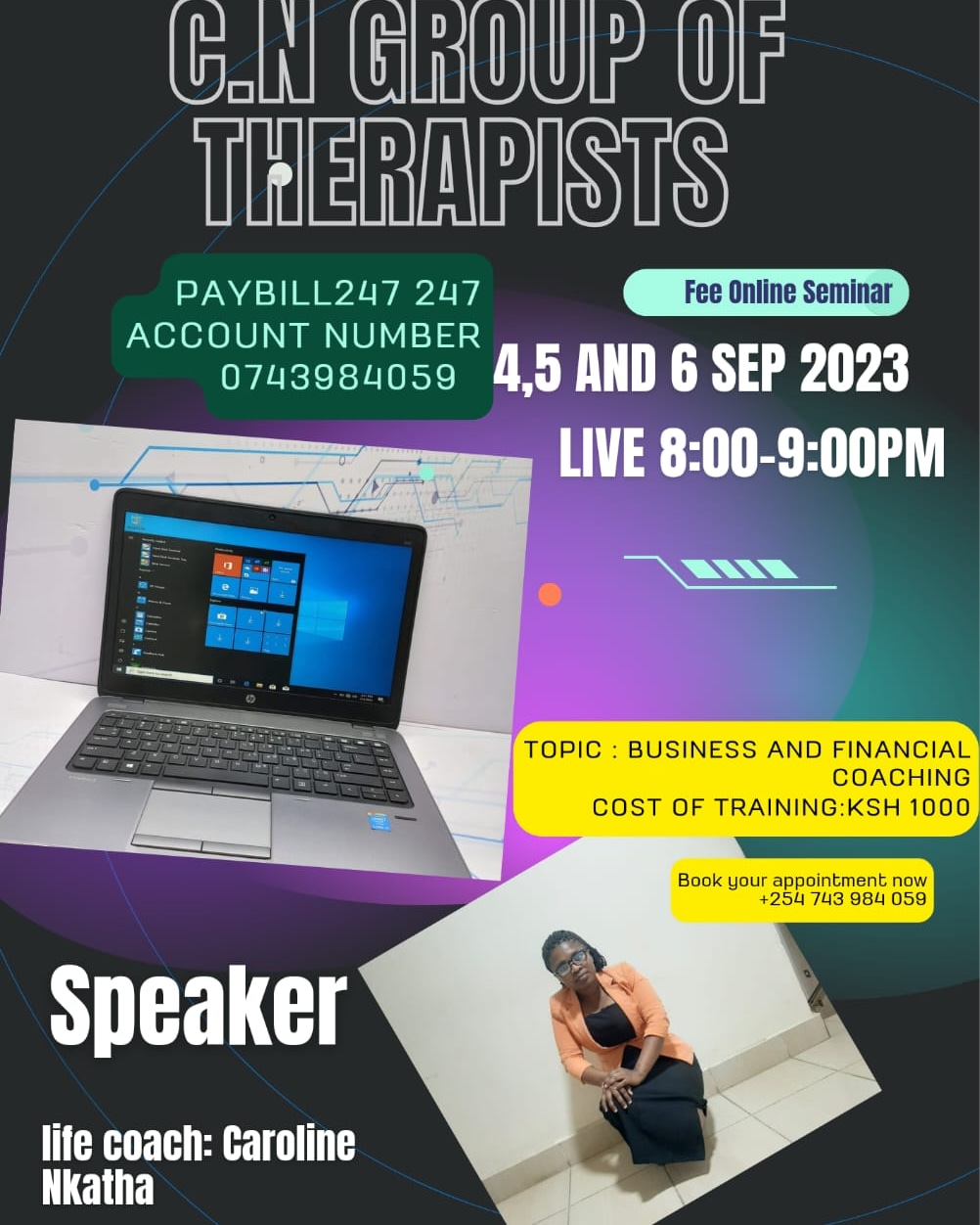

For our Mentorship/Therapy Services Call/WhatsApp+254 743 984 059 or book appointment on our website cngroupoftherapists.com

Discover more from Psychology with Nkatha

Subscribe to get the latest posts sent to your email.